Introduction

Hi, my name is ビビドット (@vividot) | Twitter.

Notes

This post was originally in Japanese and has been translated into English. Unfortunately, I am still learning English, so I do not understand the nuances of English. Therefore, it may contain incorrect translations, so I cannot guarantee the content of this blog.

In this article, I will introduce services called Uniswap v3 LP Automated Managers. Automated Manager perform rebalancing and compounding of Uniswap v3 LPs on your behalf.

Before we get into the main text, I would like to clarify that I am a supporter of Automated Managers, and this article is not intended to discredit Managers intentionally.

I view Automated Manager as a Uniswap v3 only investment fund because of its performance, depending on its rebalancing strategy. Furthermore, I believe that investment funds need to be transparent, which is why I started writing this article.

I hope that automated managers will improve over time.

Please note, this post is based on information available June 27 - July 3, 2021.

Why do we need managers?

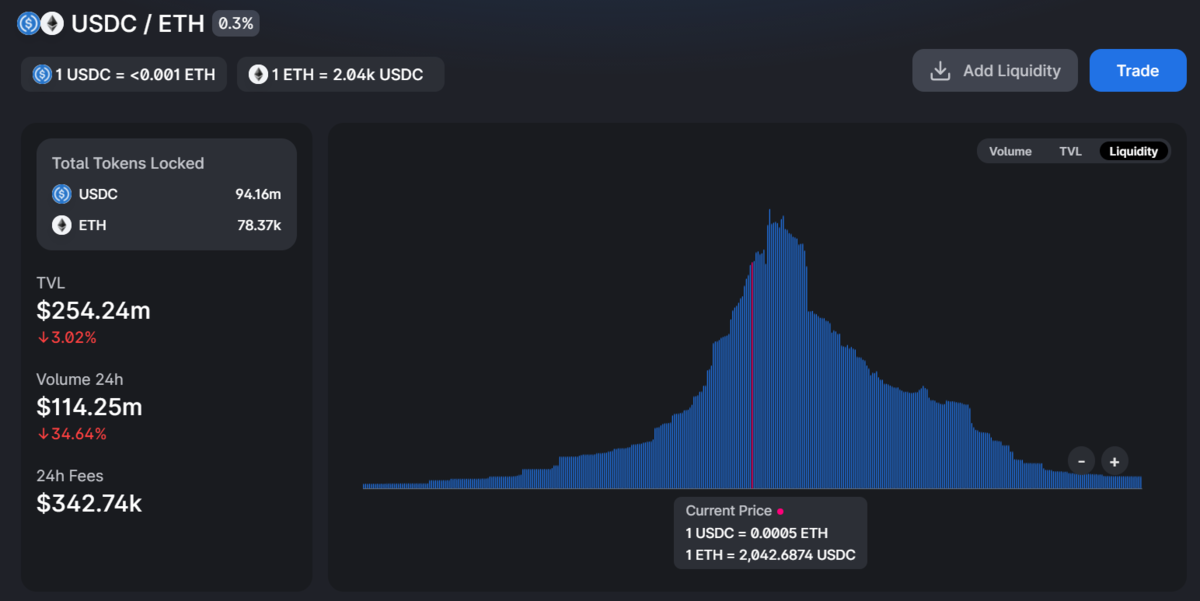

Uniswap v3 allows you to earn more LP fees than v2 by providing liquidity in a narrower range.

Therefore, those who want to earn fees will provide liquidity in the price range close to the current price.

As a result, liquidity often draws a mountain-like shape around the current price, as shown in the following figure.

On the other hand, if the price goes out of range, the liquidity provider will not earn LP fees. An out-of-range user must either wait for the price to come back into the range or remove liquidity once and provide liquidity again in another range.

The latter is called rebalancing, and the purpose of Automated Manager is to do that for automated manager user's LP. In addition, the manager will claim and reinvest the LP fees which are not automatically added to the pool in Uniswap v3.

One of the common advantages of Automated Manager is that the LP tokens issued can be made into ERC-20 tokens, which can be easily used for collateral and liquidity mining.

Organizing the rebalancing strategy

Before introducing Managers, I would like first to organize the rebalancing strategy since the performance depends on rebalancing.

How to rebalance

In the words of Charm Finance, there are two ways to rebalance: passive rebalancing and active rebalancing.

"Active rebalancing" is a method of providing liquidity in a new range by swapping tokens to be managed during rebalancing. The downside is that there is a small swap fee for each rebalancing.

On the other hand, "Passive rebalancing" does not swap tokens at the time of rebalancing but provides as much liquidity as possible with the tokens in the vault and then provides the remaining tokens as single-sided liquidity. The term "single-sided liquidity” is not clear, but the point is that it is the same as a limit order, placed close to the current market price so that if the price moves in this direction, the second position also becomes active and collects LP fees.

For example, the following diagram illustrates how liquidity is provided by 1 ETH and 2000 USDC when there are 2500 USDC and 1 ETH under the control of manager, and how single-sided liquidity is provided by the surplus 500 USDC.

When the price of ETH fluctuates between 2000USD and 1750USD, the single-sided liquidity part functions to convert the surplus USDC into ETH gradually.

It has the advantage of no fees when rebalance. However, LP fees you get will decrease compared to active rebalancing if the market continues to fluctuate to either bull/bear for a long time (because the single-sided liquidity won't work & the liquidity of the two-sided portion will also decrease).

How to choose the range

How to choose the range in rebalancing is even more important than the method of rebalancing.

When considering LP income, the best range is as tight as possible to the future range of prices. (Which is unknown)

When only considering decrease IL, it is optimal to make the range as wide as possible as v2 LP.

Therefore, each manager team uses various approaches to choose the range. However, we won't know which approach will perform better until we open the lid.

Manager Fees

Performance fees are the mainstream and are collected from Uniswap v3's LP Fee.

The fees are used to pay for gas to rebalance, buy back of governance tokens, etc. It is important to note that fees need to consider the strategy.

For example, let's say that Manager1 uses a strategy with wide ranges (low LP fee, small IL), and Manager2 uses narrow ranges (high LP fee, large IL). In this case, if Manager1 and Manager2 performance fees are the same (10%) and performance (LP Fee - IL) is also the same, Manager2 will pay more rebalance fees, which is not desirable for the user.

When to rebalance

When competitors increase, rebalancing timing may become more critical because rebalancing is the timing of compounding LP fees and realizing IL.

In addition, the single-sided liquidity of passive rebalancing becomes completely useless when the market moves in one direction. Therefore, in a trending market, passive rebalancing will need to do some active trades to re-centre the liquidity at the market price to improve fee income. However, if it is done too much, there will be a disadvantage as well, since something like "sell low and buy high" will happen on one side.

Introduction to Manager

1. Charm Finance (Alpha Vault)

Alpha vault is the first automated manager that launched v0 on May 7, two days after the launch of Uniswap v3.

Following audit, they launched two new vaults on July 2 with $1 million caps (Vaults already filled).

Rebalancing method: Passive rebalancing

Range: Specified by the development team, centered on TWAP

Commission: 5%

The following chart shows the evolution of the range of USDT-ETH. The darker light blue is the base liquidity, and the softer light blue is the single-sided liquidity.

.

.

What can be read from this is that the Manager is trying to make steady money by using a wide range to reduce IL. If the market fluctuates rapidly, there will be little damage.

Incidentally, the range width is determined by backtesting.

2. Visor Finance (Active Liquidity Management)

Visor Finance's Active Liquidity Management launched its beta version on May 18. They have also launched Gamma Strategies, which provides funding for research into strategies (actual status unknown).

Rebalancing method: Passive rebalancing (and swapping as appropriate)

Range: Based on Bollinger Bands

Commission: 10% (buyback $VISR and distribute $VISR stakers)

Visor Finance shows the range on their site. It's hard to see because it's so thin, but you can see the Bollinger Bands in gray, and when you hover the cursor over them, it reads as if the range is set according to the Bollinger Bands.

However, the author created the following chart by taking the same USDT-ETH from the on-chain data. Thus, dark green is the base liquidity, and light green is the single-sided liquidity.

Even when considering the different time periods, the two charts look different. The Visor chart implies much more frequent changes to the liquidity ranges than the on-chain data indicates.

The strategy I can see from the on-chain is to specify a narrow range and earn high LP fees while accepting IL.

In addition, once the range is set, the strategy postpones realizing IL by not rebalancing until it is out of the range, making it a strong strategy for range markets.

3. Popsicle Finance (Sorbetto Fragola)

Popsicle Finance initially managed cross-chain liquidity and launched Sorbetto Fragola on 6/26 to manage v3 liquidity.

Rebalancing method: Active rebalancing

Range: Specified by the development team, centered on TWAP

Commission: 10% (buyback $ICE)

The following chart shows the evolution of the range of USDT-ETH. Sorbetto Fragola is active rebalancing, so the liquidity is always only single position will be placed at each rebalance.

.

.

I don't know how they determine the range, but it is somewhere between Charm and Visor regarding width. They have just launched and may not have finalized their strategy yet, but it seems that they are trying to reduce the number of rebalancing because of the swap fee for each rebalancing.

HP:https://popsicle.finance/dashboard

4. Harvest Finance

Harvest Finance, which many of you may have heard of, actually offers a Uniswap v3 vault. On the other hand, this vault does not rebalance and only collects and compounds fees, so it is a little different from the managers we will be dealing with in this article.

If the range moves significantly, the developer will deploy a vault with a different range, and users who are satisfied with the vault will add liquidity.

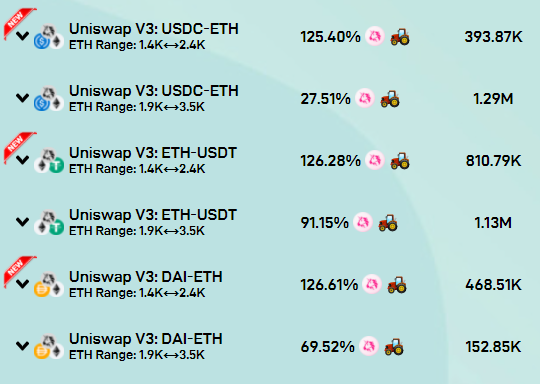

< figcaption>quote: https://harvest.finance/

< figcaption>quote: https://harvest.finance/

The following sections will introduce products that are not yet available to users in the major pool or have not been launched yet.

5. Gelato Network (G-UNI)

G-UNI provided by Gelato Network is currently used for liquidity mining and liquidity supply management of InstaDapp's governance token INST-ETH.

Other pairs will be available in the future through Sorbet Finance provided by Gelato as well.

Rebalancing method: Active rebalancing

Range: Specified by the development team (Briefly mentioned in Medium, but no details)

Commission: 10%

As I wrote about Gelato Network before, it aims to be a network of bots that execute smart contracts, and this time those bots are executing the rebalancing. vividot-de.fi

By the way, I asked the team about the range of rebalancing, but there is no detailed documentation yet, and they will announce it soon.

I think it's possible to guess by following the rebalancing tx and contract, but I won't do it.

HP: https://defi.instadapp.io/inst-pools

6. Aloe Capital

Aloe Capital claims to be a "crowdsourced liquidity allocation protocol."

The basic idea behind Aloe Capital is to use prediction markets to choose rebalancing ranges.

Users are divided into two categories: "liquidity providers" and "stakers." Of course, the "liquidity providers" are those who want to use the manager and earn LP fees by leaving it alone.

What a "staker" does, then, is to stake Aloe Capital's governance token Aloe to predict the price of the target asset. The rebalancing range is then determined by aggregating the stakers' forecasts. Stakers are rewarded with an increase in the amount of Aloe they stake if their predictions are correct and a decrease in Aloe if they are wrong.

Interestingly, traditional price forecasting is a zero-sum game (minus-sum when considering protocol fees). In contrast, with Aloe Capital, it becomes a plus-sum game by receiving a portion of the LP fees.

Rebalancing method: Passive rebalancing

Range: Aggregate staker's price prediction

Commission: 17.5% (7.5% to reserve per pool, 5% to development team, 5% to stakers)

"Dutch auctions" and "Liquidity Sniping" are also considered to promote the rebalancing of single-sided liquidity.

One of the concerns is that the protocol may not work due to the negative spiral. Not enough "liquidity providers" and not being able to attract enough "stakers". Not enough "stakers" and not being able to attract enough "liquidity providers."

7. Lixir Finance

This is probably the earliest submission of a concept to Medium, but it has not been launched yet.

The contract has already been implemented and audited, so I expect it to be launched soon.

In addition, the company has already token sales, raising 1.7 million USD through private sales and 3.27 million USD through LBP. Incidentally, the final selling price of LBP was $8.03, but due to the bear market and launch delays, the price has now dropped to about $4. ($1.53 for the private sale)

A quick look around the rebalancing of the source code, the strategy seems to be as follows.

Rebalancing method: passive rebalancing

Range: range at TWAP + single-sided range at the current price

Commission: Unknown due to variable (buyback $LIX)

8. Mellow Protocol

Twitter is frozen, and Telegram is banned from writing, so the only information we have is from the official website: "Mellow protocol is UNI V3 liquidity providing optimization solution. 🧑 🌾 Provide your liquidity and earn high returns.

The whitepaper says they aim to "derivatives realized on Uniswap v3", and the first step is to implement leveraged liquidity provisioning (LP-ing).

Leveraging LP-ing and liquidity-providing optimization at the beginning of the paper have slightly different meanings, so that they may have changed their policy.

I have not followed the formulas in the white paper, so if you are interested, please take a look at it.

HP: https://mellow.finance/vault

8. Sommelier Finance

Sommelier Finance provides an interface that makes it easier for users to add liquidity to v3 (e.g., swapping to match the range when supplying liquidity).

Since it is only an interface, for now, users need to rebalance themselves when they are out of range, but they plan to automate rebalancing using Sommelier in the future.

For more information about Sommelier, please refer to the website.

HP: https://sommelier.finance/

9. Steer Protocol

Although there is no documentation or white paper, Steer Protocol is a product that was recently selected as Sushi Incubator by Sushiswap.

The product can be roughly described as a way for users to create, participate in, and execute strategies for using any DeFi.

One of the strategies introduced is Uniswap v3's Automated Liquidity Management.

To be honest, I feel that the product is too ambitious to be successful, but I have high expectations for the future since it was selected as Sushi Incubator.

Conclusion

At the Uniswap v3 announcement, there was talk of XXX times commission with centralized liquidity. But the reality is not so sweet, and I feel that the performance is worse than v2 in major pools considering IL.

Therefore, if you want to provide liquidity to v3, you have two choices: using manager in the major pools or finding minor pools and doing manual maintenance.

Currently, the LPs that are performing well are the ones that are not out-of-range, setting a wide range as shown in the following tweet. However, for example, if the price of ETH drops or up significantly and goes out of range, the performance could be terrible.

1/ ETH/USDC position on a range from $1655 - $3334 has a 94% apr vs HODL. It has stayed within range 100% of the time for its 42 day life, has had no capital reallocation or fee collection. https://t.co/2Zk2BoVGO1 https://t.co/ta11tAIyaz pic.twitter.com/86HER3uFPS

— revert (@revertfinance) 2021年7月3日

Also, it's only been in the last month that money has started to flow into managers. As managers start to manage large amounts of liquidity, the fees of other LPs who have a wide range will decrease relative to them because the center of the liquidity will follow the current price.

On the other hand, the reality is that the Managers' performance introduced in this article is not as high as one would like, and it does not mean that you will make lots of money if you put it in. In fact, I calculate the performance using DuneAnalytics. You will see that all managers are struggling with IL, despite the differences in strategies. And depending on the period, v2 LP (without fees, only IL, i.e., worse case) may perform better.

Finally, "So if I'm going to use a vault, where should I use one?" If I compare performance over a short period, it looks like Charm>Fragora>Visor. Of course, I can't say for sure, but if I also consider manager fees, which are not factored into performance, I think the order will be generally the same.

Also, Some managers are not sincere and hard to recommend because they show a high Fee-Based APR on their website that completely ignores the existence of IL.

I will keep a close eye on performance as it needs to be looked at over a longer period, but it is interesting the results show that the wider range as Charm(Alpha Vault), the better the performance.

P.S.

I'm most interested in Aloe Capital. Still, I know from the results of Charm, Visor, and Sorbetto Fragora that it's not enough to predict the range exactly. So I'm wondering how to reward Staker or how to aggregate staker's prediction.

P.P.S.

I think my performance calculations include LP fees and IL. But, I have just started studying SQL and DuneAnalytics for a week, so there may be some mistakes. It's dirty code, but I would appreciate it if some knowledgeable person could check the SQL.

Acknowledgments

I would like to thank overanlyser.eth for English language editing. But as I said at the beginning, I'm not sure I'm translating exactly what I want to say.